Shareholders structure

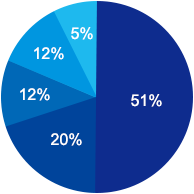

HuaAn Funds has a registered capital of CNY 150 million, which is held by five large state-owned enterprises in Shanghai.

Guotai Haitong Securities Co., Ltd.

Guotai Junan Investment Management Co.,Ltd.

Shanghai Jinjiang International Investment Management Co.,Ltd.

Shanghai Industrial Investment (Group) Co., Ltd.

Shanghai Shangguo Investment Management Co.,Ltd.

Achievements

Culture

Vision:

HuaAn Funds aims to become the most trustworthy and first-class asset management institution with global asset allocation capability and deep cultivation of China's capital market.

Management Philosophy:

Customer orientation; Stable operation; Rigorous & Honest; Profession & Diligence; Innovative & Transcendent; Cooperation & Collaboration; Sharing & Win-win; Open & Diversified.

© Copyright HuaAn Fund Management Co., Ltd. All Rights Reserved.

All information and illustrative text used in the website are used for reference only, in case of any conflict between such contents and relevant announcements and fund legal documents, the relative announcements and fund legal documents should prevail. Investors should be aware that all investments involve risks and should make investment decisions with caution.